Archives

Categories

Trusted by the world’s leading brands & improve their performance

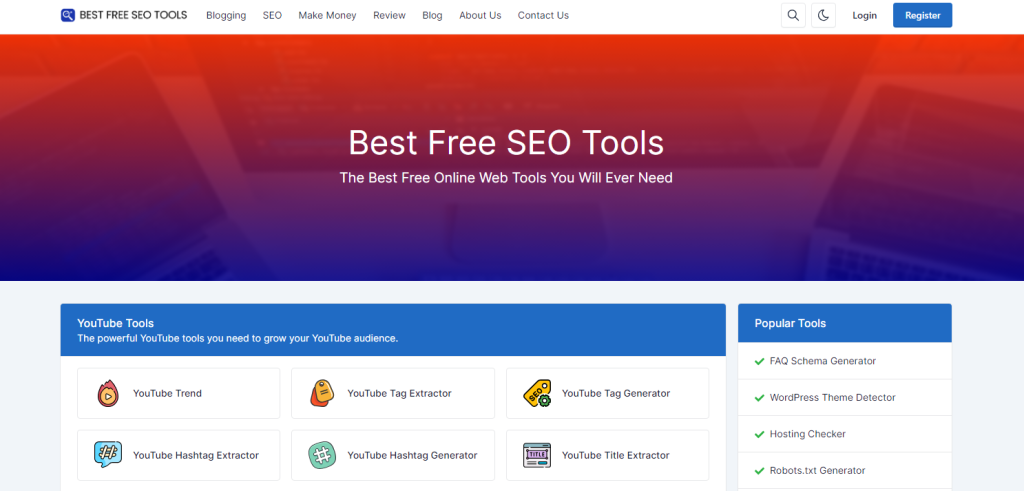

Our Categories

The Latest Post

Blog commenting refers to the practice of leaving comments on blog ...

Bluehost is a popular web hosting company that provides individuals and ...

Sales software refers to a set of digital tools and applications ...

Imagine your website as a beautiful house. You’ve poured your heart ...

Choosing the right web hosting provider is a crucial decision for ...

AAWP, which stands for Amazon Affiliate WordPress Plugin, is a powerful ...

Subscribe to Our Newsletter

Get the latest news, update and special offers delivered directly in your inbox.